The USMCA Era Begins with Challenges to the Border’s Automotive Industry

By Nancy J. Gonzalez

The North America Free Trade Agreement (NAFTA) has expired, and now the United States, Mexico & Canada Agreement (USMCA) takes its place to rule over free trade in North America.

USMCA came into effect on July 1, 2020, and sets a new framework for North American regional integration among the three nations. USMCA opens the possibility of further regional integration in areas such as digital commerce, but the new treaty is more restrictive than NAFTA in other sectors, such as the automotive industry, where the new regulations could have a negative effect.

At the U.S.-Mexico border, manufacturers and trade-related companies are preparing to meet the new criteria. This region is going to be impacted by the changes included in the new trade deal, especially those involved in the automotive industry.

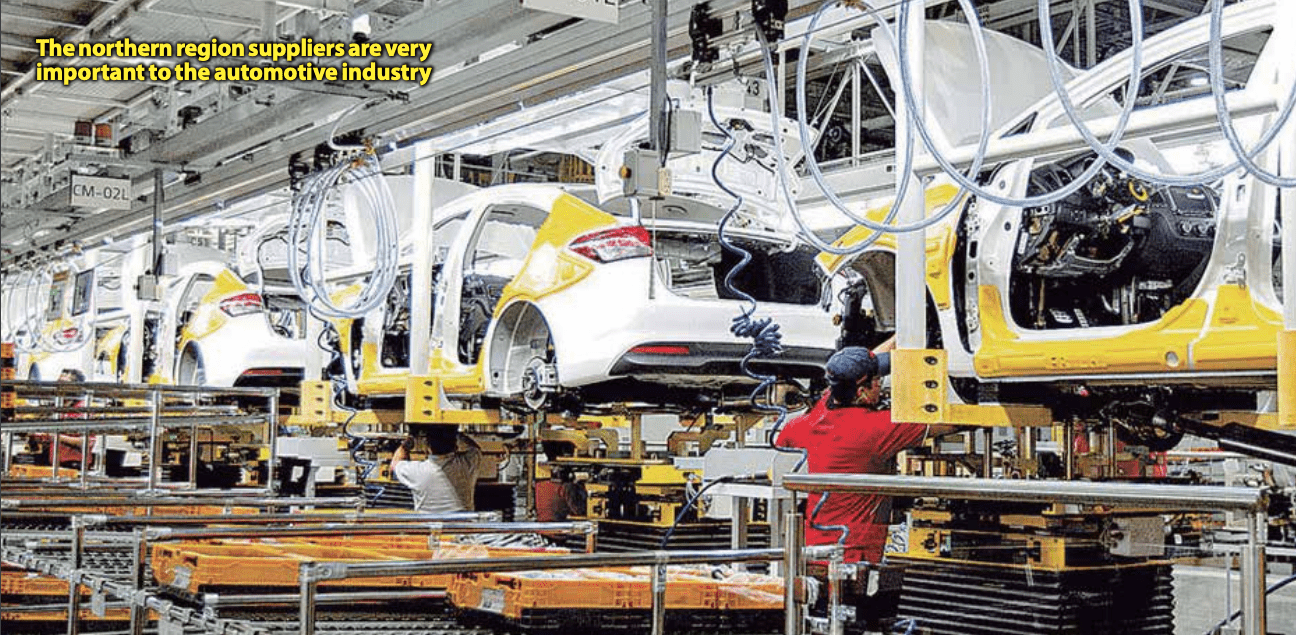

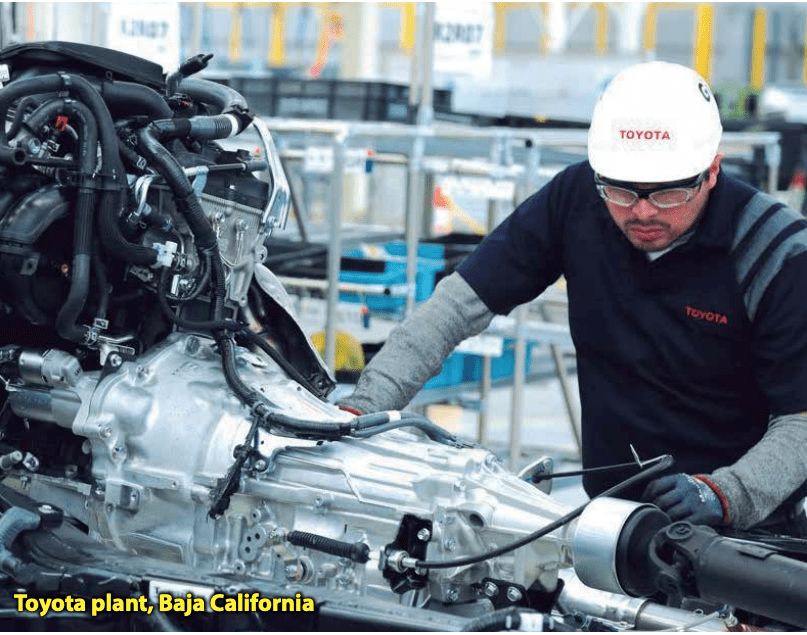

The northern region manufacturers are a main source of auto parts for the OEMs in Mexico, the U.S., and even Canada. Moreover, some vehicles are built in Mexico’s northern region such as the Toyota Tacoma in Baja and some models produced by KIA in Nuevo Leon.

The northern region suppliers are very important to the automotive industry, because they manufacture most the auto parts included in a generic vehicle. These companies provide a wide variety of electronics, engines, windshields, wipers, brake systems, lights, seats, sensors, harnesses, etc.

“What USMCA gives us today is the opportunity for the shortening of value chains in North America, where Mexico could become a very important place,” said Luz Maria de la Mora, Mexico’s undersecretary for foreign trade, in a recent Cato Institute seminar.

–

“We are basically participating in all the branches of manufacturing production, and Mexico could become a very important actor to shorten those value chains but also to keep North America competitive.”Experts said the USMCA implementation comes in a difficult time because automakers need to focus on compliance as they and their suppliers try to recover from twomonth factory shutdowns in the U.S., Canada and Mexico due to the COVID-19 pandemic. Most automotive suppliers in Mexico resumed operations early June, but some are doing it in phases to safeguard the health of their employees.

Under the USMCA, the value of regionally sourced content has increased significantly. The North American share of the value of automobiles and light trucks produced increases from 62.5% under NAFTA to 75% under the USMCA, and from 60% to 70% for heavy trucks.

Rather than applying NAFTA’s uniform local content standard for vehicle parts, the USMCA sets separate content requirements for three groups: core parts, such as engines and transmissions (75%); principal parts, like electrical and electronic parts (70%); and complementary parts, which include brake systems and miscellaneous parts (65%).

Some automotive suppliers are doing changes in their organizations to comply with the changes required by the USMCA. One of the companies shifting more production to plants in Mexico is engine manufacturer Cummins Inc. The company is moving some of its operations from the U.S., China, India and Brazil—including its filters division—to a facility in Ciudad Juarez.

“The tariffs levied by the U.S. on Europe and China are helping this process; it makes companies look to Mexico as a place where they can relocate production lines to supply the U.S. market,” said Cummins Latin America Vice President Ignacio Garcia, at the time of the announcement.

Additionally, there are new restrictions regarding the origin of steel, aluminum and vehicle parts used in the production process and new requirements governing labor value content and the wages paid. At least 70% of the steel and aluminum used in the manufacture of automobiles and light trucks must originate in the U.S., Canada or Mexico.

“It’s going to be hard work with our suppliers to meet the new rules, especially the steel and aluminum requirements and the labor content value,” said to Reuters Miguel Elizalde, head of the Mexican association of heavy vehicle makers, ANPACT.

The U.S. Trade Representative recently released the rules of the road that automakers must follow to continue to avoid tariffs. The documents lay out definitions for terms that will be used to measure compliance with the new trade rules, such as accessories, spare parts, tools and customs value.

–

In a recent MexicoNow Webinar, OEMs doing business in Mexico said their companies are willing to increase the supply chain to reduce the auto parts imported, and highlighted the importance of developing tooling capabilities in the country and finding local suppliers in aluminum and raw material. “We have the challenge to develop the Tiers 2 and Tiers 3. More than 50% of auto parts are from abroad,” said during the Webinar Joaquin Loose, CoCEO Hitachi Automotive Systems Mexico. “Mexico must be vigilant to find opportunities.”

Requirements for labor value content were introduced in the USMCA: 40% of the materials for automobiles and 45% of the content for light trucks must be produced by regional enterprises that pay workers at least US$16 per hour. Companies having their headquarters in the U.S. might account some R&D jobs into this requirement.

An analysis published by the Federal Reserve Bank of Dallas shows since Mexican autoworkers currently earn about US$7.30 per hour for auto assembly and US$3.40 while making automotive parts, this new provision most directly affects Mexico.

It says the USMCA requirements could make automotive production less efficient and decrease the competitiveness of the automotive industry across the North American region relative to the rest of the world.

“In the baseline scenario, more restrictive rules-of-origin requirements will increase production costs that, in turn, will imply higher prices, reduced output, and a decrease in consumer surplus in the region,” the document reads. “Furthermore, at the regional level, spending on the transport equipment sector will shift away from local producers and toward foreign suppliers of these goods.”

The changes included in the USMCA are worrying some companies in the U.S., too. DHL’s 2020 International Trade Impact and Outlook survey also found that optimism for doing business in North America was down among small- and medium-sized enterprises (SMEs). Only 30% of U.S. businesses said Canada and Mexico would be a central business focus in 2020, compared to 55% of respondents last year.

In the survey, 42% of respondents said their business will be significantly or moderately impacted by the USMCA, while other 35% said their business will not be impacted at all by the treaty. Also, 15% of SMEs said they are taking a more aggressive approach on global trade this year, but 32% of respondents said Asia is the top priority region for business in 2020.

Meanwhile, the automotive industry is little by little adapting to the new USMCA rules. Auto parts suppliers are making changes in their organizations willing to meet the new requirements while OEMs are looking into opportunities to increase their regional content, looking for suppliers who can meet the quality and price they need to remain competitive.