Energy Outages Disrupted Manufacturing in Mexico

By Nancy J. Gonzalez

Manufacturing sites in northern Mexico stopped production again. This time the pandemic was not the cause of this interruption but the lack of energy in factories, especially those using natural gas. Mexico was rationing imported natural gas in response to unprecedented supply disruptions in the Southern U.S., where severe cold wreak havoc across the energy and industrial chain.

The lack of infrastructure to store natural gas and the scarce production of natural gas in Mexico worsened this situation since Texas is the main supplier of natural gas. Mexico increasingly relies on pipeline gas from the U.S. for electricity generation as domestic gas production has declined over the past decade.

Nowadays, Mexico’s cross-border gas pipeline capacity is split between around 7 billion cubic feet per day (Bcf/d) in independently operated pipelines serving state-owned utility CFE, and 7 Bcf/d in the Cenagas-operated system. Flows in the CFE system were reduced by 1 Bcf/d, CFE informed. Power outages sparked by gas supply shortages starting on February 15 and spreaded to 29 Mexican states. The arctic weather in Texas froze natural-gas pipelines between the two countries, according to Mexican energy officials. This situation, coupled with a surge in demand for gas in the U.S., disrupted energy production across northern Mexico and left 4.7 million customers in Mexico without power for a few days.

Blackouts led to production losses because manufacturers in Mexico were not able to operate. Luis Hernandez, INDEX president, said the losses were up to US$200 million per hour, reaching US$2.7 billion in just two days.

“The most affected states are Chihuahua, Coahuila, Nuevo Leon and Tamaulipas. Sonora and Baja California are not connected to the national electricity grid; therefore, their situation is kind of different,” explained Hernandez.

In some regions, such as Matamoros and Reynosa, the manufacturing facilities shutdown their operations entirely because those cities have no electricity supply.

“At the end of the day, our losses will be higher because we will have to pay overtime to fulfill our orders and be in compliance with our clients,” said Rosalinda Torres, president of INDEX Matamoros.

INDEX figures show these electricity and natural gas outages are affecting at least 2,600 manufacturing sites in Northern Mexico and more than 1.2 million employees. In Ciudad Juarez, at least 150 manufacturing sites had no natural gas flow for at least two days, because the local natural gas supplier—Gas Natural del Norte—shutdown their supply to ensure domestic users’ availability.

Ramon Martinez, regional coordinator at Gas Natural del Norte, said the industrial shutdown was necessary to ensure the supply for domestic use once their natural gas suppliers’ advice the company of a lower flow of this fuel due to the climate contingency.

Also, Governor Greg Abbott warned all-natural gas exports could be suspended for a while as part of Texas’s effort to resolve widespread power outages that have left millions of Texans without electricity in the middle of a winter storm. “The natural gas outages were for high-consumption clients. Manufacturers are in this category and many of them use natural gas as a raw material in their processes and cannot operate without them,” said Fabiola Luna, president of INDEX Juarez.“Some had to suspend operations temporarily.”

U.S. gas pipeline exports to Mexico fell from 5.7 Bcf/d to 3.8 Bcf/d during this time, according to data from Refinitiv. In 2020, 27% of Texas’ gas exports came to Mexico, Mexico’s Economy Ministry data shows. Ana Laura Ludlow, commercial vice president at ENGIE Mexico, said during an energy forum hosted by INDEX that Mexico cannot remain passive, even though this was an isolated event.

“Mexico only has the capacity to store 25% of its daily natural gas consumption,” Ludlow informed. “The country should be able to store up to seven days of its total consumption to be prepared for an outstanding situation, but it lacks infrastructure to do so.”

The U.S. and Mexico require intricate supply chains to be functional to supply auto and other industrial operations on both sides of the border.

The Mexican Association of the Automotive Industry (AMIA) reported temporary suspension of operations in auto assembly plants, while others had to cut down consumption of natural gas by between 20% and 30%.

Ford Motor Co. reported the closure of its Hermosillo plant and others in the U.S. Volkswagen said it would suspend some production in Mexico for two days due to limited natural gas supply. Moreover, the cut in supply also affected Audi in Puebla as well as GM’s plant in Silao, where work stopped for two days.

A Growing Pipeline System

Exports of natural gas to Mexico by pipeline are the largest component of U.S. natural gas trade, accounting for 40% of all U.S. gross natural gas exports, according to the U.S. Energy Information Agency. Most of this trade is done via Texas.

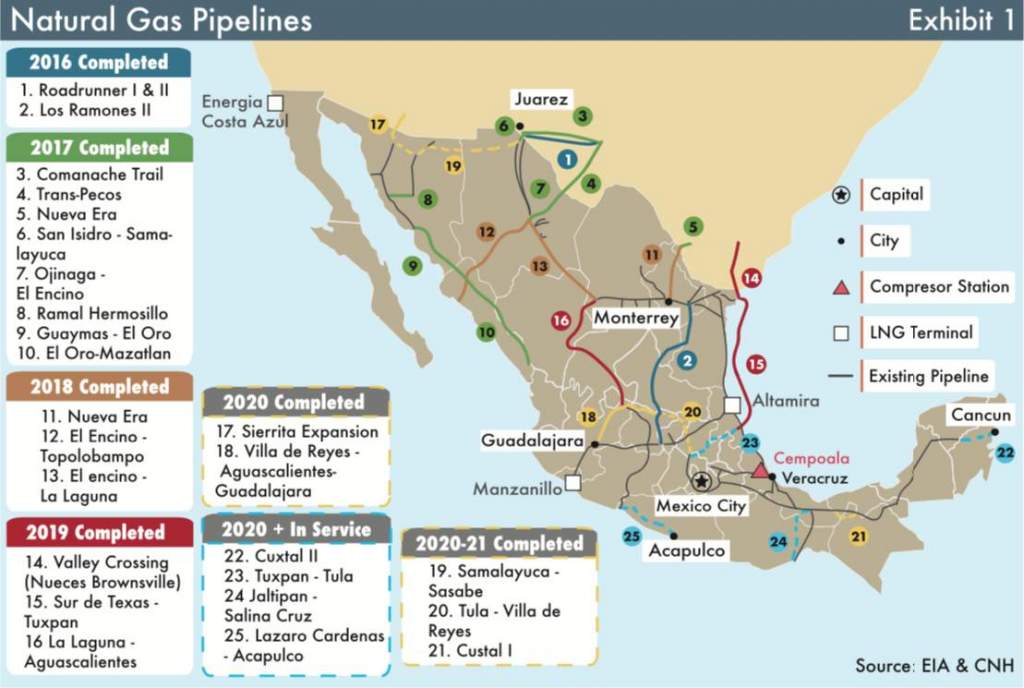

Since 2016, Mexico has been expanding its natural gas pipeline system, which has supported continual growth in U.S. natural gas exports. Most of this growth has been in U.S. natural gas exports from southern Texas after the existing U.S. pipeline infrastructure was expanded.

In the last five years, new pipelines have been incorporated to the system to fulfill the growing demand in Mexico. The most recent completed project is the Villa de Reyes-AguascalientesGuadalajara (VAG) pipeline, which is the southernmost segment of the Wahalajara system.

VAG began operations in June 2020, connecting new demand markets in Mexico to U.S. natural gas pipeline exports.

The Wahalajara system is a group of new pipelines that connects the Waha hub in western Texas, a major supply hub for Permian Basin natural gas producers, to Guadalajara and other population centers in westcentral Mexico.

The Sur de Texas-Tuxpan pipeline was completed in September 2019 and boosted the U.S. natural gas exports to Mexico to a record 5.5 Bcf/d in October 2019. Still only 20% of the pipeline’s capacity is being used, which goes from the Brownsville border all the way down to Veracruz.

Moreover, two regional pipelines were completed in 2017 but have not been used near their capacity: the 1.1 Bcf/d Comanche Trail pipeline, w hich deliver s n atural g as to Mexico from San Elizaro, Texas, and the 1.4 Bcf/d TransPecos pipeline, which crosses the border at Presidio, Texas, according to the EIA data.

The Trans-Pecos pipeline, the U.S. segment of the Wahalajara system, did not transport significant volumes of natural gas until October 2018. It is currently only operating at 10% to 15% of its total capacity. Most of the demand centers are in southern Mexico, waiting to be connected to the VAG pipeline.

Before the economic impacts and uncertainty associated with COVID-19 mitigation efforts and declining crude oil prices, S&P Global Platts expected U.S. natural gas exports to Mexico to increase immediately by 0.3 Bcf/d to 0.4 Bcf/d on the Wahalajara system.

However, given the decreased demand for natural gas in Mexico in response to the economic impact of COVID-19 mitigation efforts, growth is likely to be slower than expected.