Electric Vehicles Fuel Manufacturing at the U.S.-Mexico Border

By Nancy J. Gonzalez

Electric vehicles (EVs) are changing the manufacturing pattern at the U.S.-Mexico border. As EVs gain popularity around the world, OEMs are turning to this region to start new operations while some suppliers are modifying their manufacturing sites to produce the auto parts needed for these new vehicles.

In Arizona, three companies are manufacturing EVs near the Mexican border. Recently, ElectraMeccanica Vehicles Corp. announced its SOLO three-wheeled, single-seat vehicles will be manufactured in Phoenix. Moreover, Silicon Valley-based Lucid Motors has begun manufacturing pre-production versions of its high-performance luxury Air cars in Casa Grande; and in Coolidge, Phoenix-based Nikola Corp. will complete the first phase of its heavy trucks’ factory by the end of this year.

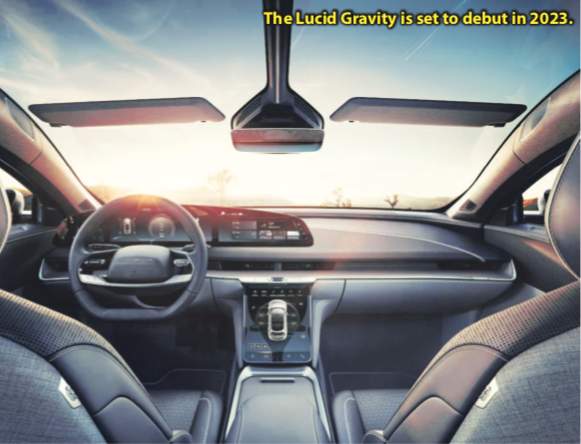

In Casa Grande, Lucid Motors has completed the first of four phases in its Advanced Manufacturing Plant, and the campus will eventually total 5.1 million square feet by the 2028 build-out. The second phase will begin in the second quarter of 2021, and the company’s Project Gravity SUV will begin production in 2023.

In Coolidge, Nikola Motors is nearing completion of its first-phase 270,000-square-foot building, while ElectraMeccanica scheduled to be fully operational in March 2022. The plant will begin manufacturing SOLOs later that year, producing as many as 20,000 vehicles annually.

On the other side of the border, Tesla is building Giga Texas. The US$1.1 billion facility will manufacture the company’s new pickup truck Cybertruck as well as the Tesla Model Y and Tesla Semi, a tractor-trailer as well as Tesla’s Model 3. The facility is set to start production sometime this year.

Moreover, Foxconn wants to enter the EV market and the company has already made public the production might go to the U.S. or Mexico. Foxconn has already a facility in Northern Mexico in Ciudad Juarez. As an important Apple supplier, speculation has focused on whether Foxconn would team up with Apple to make a car.

But the investment is not only coming from auto manufacturers; suppliers are also changing their manufacturing sites to include the new products needed for EVs.

Recently, sources said Pegatron will build a plant in El Paso to supply Tesla. Tesla has already some suppliers in the Juarez-El Paso region and the orders might increase once Giga Texas starts operations in Austin.

Still, this EV surge worries some. Some auto industry experts believe the transition to EVs will lead to fewer manufacturing jobs, because most of the new technology uses automated production processes. EVs also require much less maintenance than gas-powered cars, which could lead to fewer auto repair and maintenance jobs.

“When it comes to the U.S. auto industry, the reality is that we have a long way to go in terms of battery technology, refueling infrastructure and, importantly, market demand in order to successfully make this transition to electric vehicles,” said Rory Gamble, president of the United Auto Workers Union, in a statement on the UAW website. “We also need to ensure that this transition is stable, reliable and creates quality union wage jobs and flexible to market demand not relying on a one-size-fits-all solution.”

Moreover, the UAW expressed the growth of EVs must be an opportunity to re-invest in American manufacturing, with union workers making the vehicles of the future.

“But, to make sure this disruption does not leave American autoworkers behind, government subsidies and tax breaks for the transition to new technology must be paired with a commitment to locate these jobs in the United States at comparable wages and benefits to the jobs they replace,” the UAW said in a statement.

Marick Masters, a Wayne State University business professor who specializes in labor issues, forecasts about 35,000 hourly jobs could perish across the auto industry as automakers move to EVs.

Furthermore, the shift to EVs means replacing key powertrain components, such as engines and transmissions, with mechanically simpler lithium-ion batteries and electric motors. Traditionally, powertrains have often been made by automakers themselves while EV batteries are mostly made by suppliers in other countries, with China in the lead. The UAW fears the change will force automakers to form joint ventures with battery companies, which will “increase outsourcing or erosion of job quality in the industry.”

“It is vital that we create a strong domestic supply chain that creates quality auto jobs,” expressed the union in a statement.

Even though the transition to EVs is not going to happen overnight, the electric vehicles sales have grown steadily over the past decade. Still, EVs along with plug-in hybrid electric vehicles (PHEVs) represent a fraction of vehicle sales, around 2% of all U.S. auto sales.

The 2021 EV Outlook Report published by BlastPoint shows more than 345,000 electric vehicles were sold in the U.S. in 2020 despite the economic downturn, surpassing the 245,000 sold the previous year. The best-selling new models, according to the report, are all Tesla models. The Tesla Model 3 sold 38,000 units in 2020, while the Tesla Model Y and Model X sold 18,000 and 9,000 vehicles, respectively.

Recently, U.S. President Joe Biden unveiled his infrastructure plan which includes US$174 billion for electric vehicles, including hundreds of thousands of charging stations, tax incentives for electric cars, and government fleets that are all electric.