FDI in Northern Mexico Plummeted in 2020

By Nancy J. Gonzalez

The geographical location as well as the expertise of the manufacturing companies in Northern Mexico are no longer enough to attract Foreign Direct investment (FDI) to the region. In the last two years, FDI in this region has been down due to the uncertainty created by the federal government and in 2020 because of the COVID-19 pandemic.

The Ministry of Economy (SE) reported a total of US$29.07 billion in FDI in 2020, this figure is 11.7% less than in 2019. In 2019, Mexico reported a US$32.92 billion in FDI. The main investors are still Mexico’s North American partners: the U.S. with 39.1% and Canada with 14.5%.

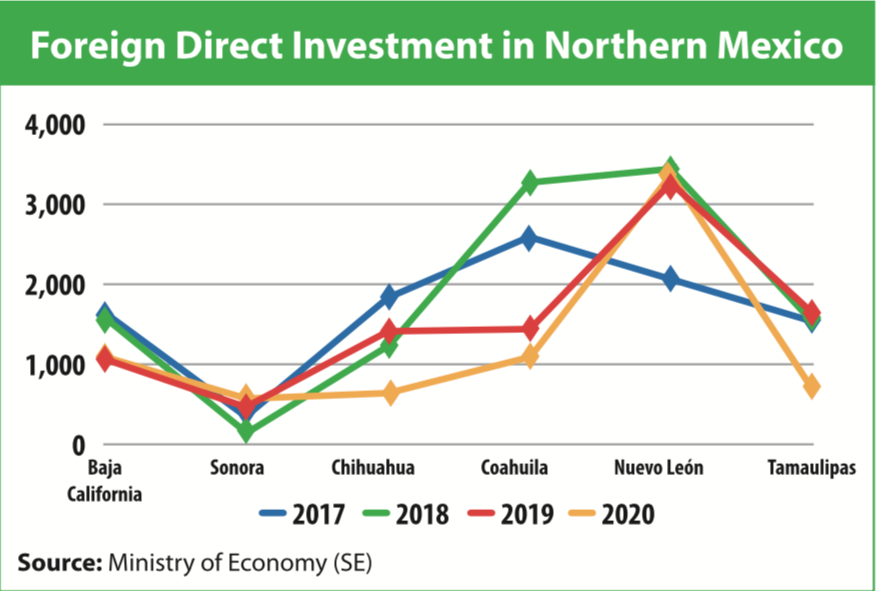

Last year, the six northern Mexico states accounted US$7.45 billion or 25.8% of all FDI in the country. This figure seems to be high, but the region usually accounts more than 30%. In 2018, the region got 36.2% of all the foreign investment coming to Mexico.

The federal government argues in its 2020 FDI report that the COVID-19 pandemic is the one to blame for these modest numbers, but analysts and specialized reports tell otherwise.

Mexico is no longer part of the 2020 Kearney Foreign Direct Investment Confidence Index. In 2019, Mexico was in the bottom of this list in the 25th place. Furthermore, the only other year that Mexico was left off the index, which was first released in 1998, was in 2011. Mexico has also fallen three places in the ‘World Competitiveness Ranking 2020’ released by Swiss business school IMD, dropping from 50 to 53 out of the 63 places available.

“Right now, Mexico is less attractive for FDI,” Ricardo Haneine said at a virtual press conference.

He considered that investors see negatively the low historical and expected growth for the country, as well as the lack of an economic and social development plan with a clear and articulated strategy.

In the Kearney report, investors classified as very negative the decisions of the current federal government regarding the energy sector in the country, such as the cancellation of rounds for private participation in exploration and production as well as little clarity in the public policy of generation of clean energies.

Still, the cancellation of the New Mexico City International Airport (NAIM) at the beginning of the Andres Manuel Lopez Obrador (AMLO) administration is on the mind of investors.

Manufacturing accounted 40.6% of the FDI in Mexico. Luis Hernandez, INDEX president, said the sector is strong and the USMCA and nearshoring are important factors to attract investment, but all sectors must work together.

“The Mexican government should avoid uncertainty,” Hernandez expressed.

Hernandez said Asian investment is coming to Mexico, especially to the border region, but the government should not rely only on this trend but promote worldwide the advantages of manufacturing in Mexico.

The SE report shows Nuevo Leon as a Top 3 recipient for FDI in Mexico. This northern state accounted in 2020 a total US$3.36 billion or 11.6% of all the foreign investment in the country. The data shows Nuevo Leon had a positive trend in the last five years.

“Last year, Nuevo Leon attracted 8% more FDI compared to 2019. This figure is even more relevant considering the health contingency that persisted during 2020 in Mexico and in the world,” said Roberto Russildi Montellano, Secretary of Economy and Labor of Nuevo Leon.

Some of the foreign companies that invested in Nuevo Leon in 2020 include Mercado Libre, Black & Decker, and Kuka Home.

Even though the federal government forced Constellation Brands to quit its project in Baja California, foreign investment kept flowing to this state. Companies such as Eson Multiwin and Motorcar bet on new facilities in this northern state. The SE report shows FDI in Baja California accounted US$1.07 billion, down from US$1.63 billion in 2019.

Coahuila cut its FDI flows more than half in 2020. In 2019, Coahuila registered US$3.27 billion and in 2020 it went down to US$1.44 billion. Its share is 3.8% of the total FDI in Mexico. Some of the companies that invested in Coahuila last year include Alfagomma and NAI.

Tamaulipas also reduced more than half its FDI from 2019 to 2020. Last year, this state only attracted US$688.1 million or 2.4% of the national total FDI. The previous year, this state performed well with US$1.62 billion.

Moreover, Sonora increased its FDI with US$578.4 million during 2020 or 2% of the national figure. In 2019, this state got US$468.3 million. The 2020 was one of the best years this state to attract investment from foreign companies. One of these corporations was Bencton Dickson. The most attractive sectors in this state last year were automotive, telecommunications, and renewable energy.

Even though many corporations expanded or started new operations in Chihuahua, this border state got the lowest FDI since 1999. Last year, Chihuahua only captured US$632.3 million or 2.2% of the national figure. Chihuahua has performed poorly in the last years, but 2020 was the worst and was taken out of the Top 5 recipients, the official figures show. Some of the companies that grew or started operations in Chihuahua included: BRP, Ergomotion, Leviton, Dart Aerospace, Safran, Incora, Borg Warner, Flex and Logda Plastics.

In previous years, the northern states used to announce new investments regularly, while new companies were willing to relocate in their border cities, but in 2020, almost no announcements have taken place. Most of the new investments have been organic; therefore, they were made by existing firms.