Industrial Real Estate Booms at the U.S.-Mexico Border

By Nancy J. Gonzalez

The United States-Mexico-Canada Agreement (USMCA) as well as the nearshoring and the growing e-commerce during the COVID-19 pandemic have been boosting real estate along the U.S.-Mexico border.

The demand for industrial space is on both sides of the border buoyed by the opening of new distribution centers and last mile locations for e-commerce, while the border population has also been increasing its online shopping and home deliveries.

El Paso has recently kept the attention of investors to open distribution centers. Mid-2020 Amazon announced plans to open a 625,000-square-foot fulfillment center in El Paso. Later, the TJX Companies informed it will build a distribution center there too that may be up to 2 million square feet.

A few miles away, FedEx Ground is putting the finishing touches on a 215,000-square-foot building in Santa Teresa, Nuevo Mexico, that will serve as a shipment distribution hub for the region.

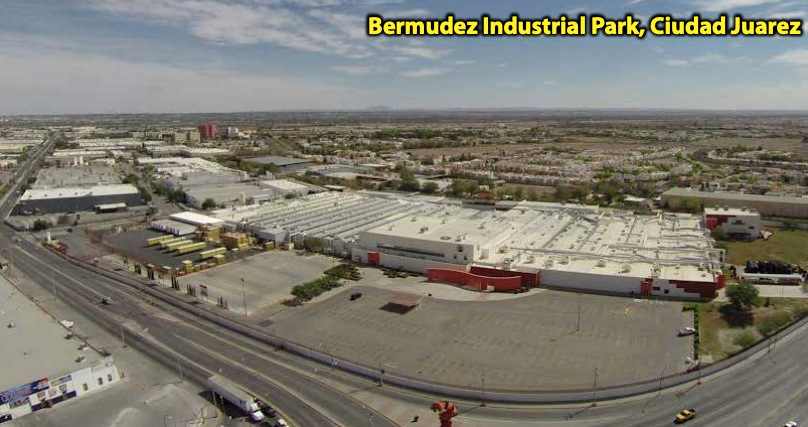

In Ciudad Juarez, on the other side of the border, companies are also looking for space. The latest CBRE analysis shows Class A vacancy dropped from 3.3% to 2.3% while Class B accounted for 57% of all available space.

“Delivery of the new supply ranges from late 2020 or early 2021 and will offer some relief to industrial users in the market who closed Q3 2020 seeking an above average 3 million square feet,” the report adds.

But the central part of the U.S.-Mexico border is not the only region having an increase demand for industrial space.

“Industrial property developers in Mexico report increased activity in the electronics industry and consumer markets in Mexico’s largest cities, including Mexico City, Guadalajara and Monterrey, as well as nearshoring taking place in cities along the border, including Tijuana, Ciudad Juarez and Reynosa,” said Alma Ortega Lopez, American Industries Group Institutional Relations director.

In Tijuana, companies are looking for industrial space to start new operations, to expand or to fulfill the need of space for e-commerce-related activities.

“Tijuana is currently one of the strongest markets, particularly in medical device industries, as well as electronics and also even e-commerce. This is a similar situation to which are lower vacancy today,” said Lorenzo D. Berho, Vesta’s CEO, during the company’s latest conference call. “Tijuana has seen an important increase in rent because of the lack of supply and the high demand, and I think that because of that we’re going to be able to capitalize with a potentially good payment, a good lease and a good leasing rate.”

Furthermore, the U.S. Sun Belt, in general, will continue to shine with Southern California’s Inland Empire, Phoenix, Las Vegas, Reno, Salt Lake City and Denver experiencing solid industrial development due to their proximity to burgeoning populations, CBRE said.

The Inland Empire colossus will remain the dominant big-box industrial market for the foreseeable future. The firm defines industrial development as a combination of manufacturing and warehouse logistics.

The situation is similar on the opposite side of the border. Cities like Reynosa and Monterrey are increasing their real estate activity and 2021 seems to follow the same path.

The CBRE report shows industrial market in Reynosa has remained active despite the current contingency. The vacancy rate recorded a historical low of 1.4% due to the fact that the construction of speculative space has decreased in the area during recent years, and vacant class A space has been mostly leased.

“Even with the impact of the current pandemic, Reynosa’s industrial market has been one of the most resilient in the country.

Industrial demand in the area has increased against the previous year and continues to position itself as an excellent option for foreign companies seeking proximity and fast connectivity to the U.S.,” the report reads.

In spite of the current contingency, industrial activity in Monterrey has remain active throughout the year, reaching gross demand of more than 2.1 million square feet during Q3 2020, while its cumulative demand for the first nine months totals 5.2 million square feet, 15% lower than in the Q3 2019, CBRE reports. The vacancy rate closed at 7.2% with slight increase against the previous quarter.

“Stability and industrial growth in the state has led to expansion of existing companies as well as the arrival of Asian companies and investment form logistics and e-commerce companies.,” the report adds.

Recently, Mexican retailer Coppel announced it will build a distribution center in Monterrey. Vesta is in charge of this project.

“Our strong position is also enabling us to capture near-term opportunities, such as the ongoing shift in consumers buying habits toward more online purchases. This shift is expected to create more opportunities in markets where we own land, but offers last mile advantages, such as Monterey, a new geographic market for us where we recently signed another anchor tenant in the e-commerce sector,” said Berho.

Also, Fibra Prologis has invested recently in Monterrey, acquiring two assets. Both properties are leased for three years to a top home furnishing company headquartered in China, who will export to the U.S. market from these locations.

“These newly developed properties complement our portfolio in Monterrey where we have seen great leasing momentum and higher rents relative to last year,” said Luis Gutierrez, CEO, Prologis Mexico. “These properties are in the most desirable sub-market of Apodaca and clear evidence that nearshoring is driving demand in Mexico.”

Other companies such as FINSA have also bought assets in Nuevo Leon.

On the other side of the border, the outlook for the Southeast and Southwest markets is one of the bullish narratives in a very positive 2021 forecast for U.S. industrial real estate. E-commerce activity has soared due to store closings and health concerns over congregating in crowded brickand-mortar environments. This trend, which many experts believe has secular legs, has sent delivery and warehouse utilization levels rocketing higher.

Keith Patridge, president and CEO of McAllen Economic Development Corporation, said the pandemic has revealed a critical shortcoming in the global supply chain, coupled with the implementation of rules for the new USMCA and changes in consumer demand has resulted in a shift to the re-shoring of manufacturing.

“If these early trends continue, it could create significant opportunities for manufacturing and the necessary support services in our border region,” he added.

Moreover, warehouse demand will be further enhanced fueled by a greater emphasis on inventory control and local product sourcing and less on the intercontinental “just-in-time” distribution formula that eschews inventories in favor of fast-cycle deliveries to end markets. Importers spooked by the continuing inventory dislocations due to the pandemic are expected to increase on-hand inventories to a 60-day supply from current stocking levels of 15 days, CBRE said.

The U.S.-Mexico border has continued to show resilience during the pandemic. Along with other factors, the forecast for the region is positive for this year, but communities must be prepared for the upcoming changes.