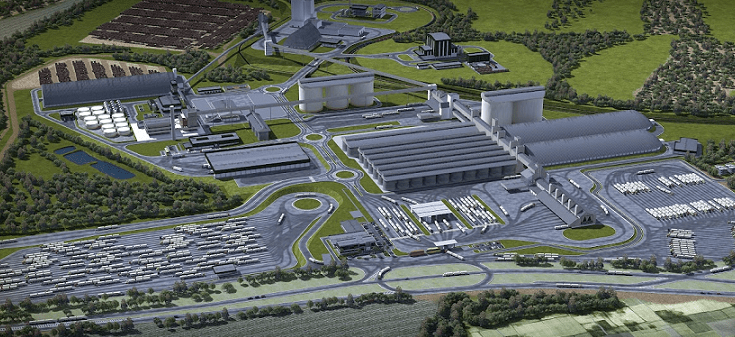

Industrial supply in Saltillo reaches 5 million square meters

The industrial sector in Saltillo added 114,000 square meters (m2) during Q1 2025, remaining above pre-pandemic levels, according to CBRE Mexico in its MarketView report.

According to the consulting firm, this trend was mainly driven by the delivery of pre-leased projects that were under construction, maintaining a positive course despite vacancies.

“This growth in net absorption in recent years has reduced the vacancy rate and kept it at its lowest levels. A recovery is expected with the new supply that will be added to the inventory in the coming months.”

In addition, the new quarterly supply was the second highest on record, bringing the local inventory to over five million m2, positioning it among the largest markets nationwide.

During this period, 68,000 square meters of new construction starts were also recorded, maintaining a very active pipeline that exceeds 248,000 square meters.

According to CBRE figures, speculative construction continued to rebound in the state. It is important to highlight this fact, after months of a trend of pre-lease and built-to-suit projects dominating the market.

“Currently, there are 117,000 m2 available that will be added to the inventory in the coming months, as well as 80,000 m2 about to begin construction.”

The vacancy rate closed Q1 2025 at 2.0% of existing inventory, a slight increase compared to the same period last year (0.7%).

It should be noted that the Ramos Arizpe submarket accounted for most of this indicator and that 77% of the current supply was concentrated in second-generation warehouses.

Likewise, the automotive and logistics sectors were the main drivers of industrial demand in Saltillo during the quarter.

In terms of employment, the Mexican Social Security Institute (IMSS) reported that Coahuila accumulated 3,802 new formal jobs created at the end of February. Eighty-two percent of these were generated in the Saltillo metropolitan area.

Finally, CBRE indicated that gross absorption closed at 61,000 m2, exceeding pre-pandemic levels. Activity was mainly concentrated in the Ramos Arizpe submarket (72% of quarterly demand), followed by Saltillo (24%) and Arteaga (4.0%).