Maquiladoras Battle Pandemic & Bureaucracy

By Nancy J. Gonzalez

The COVID-19 pandemic caused the unthinkable in Mexico: it stopped production lines in maquiladoras. For several months, companies have modified their manufacturing facilities, making them more secure for their workers to lower the risk of infection. INDEX President Luis Aguirre Lang shared with BORDERNOW readers the changes, challenges and opportunities manufacturers in Mexico have been facing in the last months.

What is the panorama for manufacturers in Mexico after the COVID-19 pandemic outbreak?

In April and May we had a 50% drop in exports. In June, we exported more than US$19.4 billion, which represents the monthly average of the first months of this year. This allowed us to generate a surplus of US$6 billion, which is very similar to the surplus we had in February 2020. We can say that this is the return to the new normal in the IMMEX sector. This export industry is the engine that can lift our country out of this postCOVID economic downturn.

How has this pandemic affected companies?

We had impacts in different scenarios. First, we understand that this is a global pandemic, we are beginning to have international supply problems. Almost 70% of our supply comes from Asia, where the COVID-19 pandemic started.

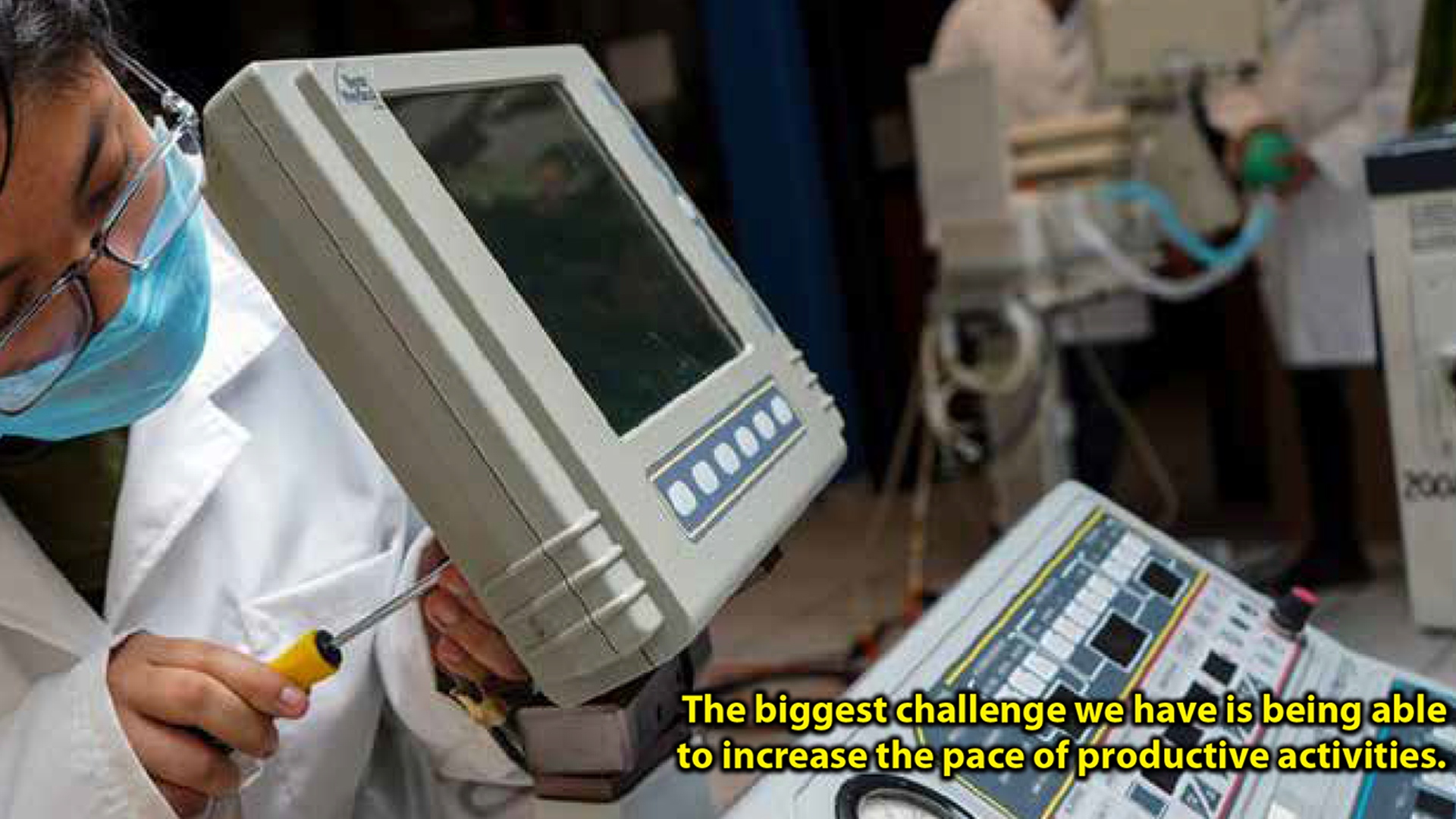

In February and early March, we began to experience significant input supply problems. Later, when the pandemic hit Mexico, it forced us to close non-essential operations. As a result, we began to generate supply problems for our international clients in other parts of Maquiladoras Battle Pandemic & Bureaucracy By Nancy J. Gonzalez Luis Aguirre Lang INDEX President The biggest challenge we have is being able to increase the pace of productive activities. BORDER NOW OCTOBER 2020 17 18 OCTOBER 2020 BORDER NOW the world where they were already emerging from the disease.

As of June, with the reactivation of our activities practically throughout the country, we have been able to begin to see the positive effects very quickly.

However, there are aspects that concern us a lot and they have to do with employment. Unfortunately, we had a significant decline in the first half of this year, with around 100,000 lost jobs. I’m confident that the numbers will change soon and we will have a slight rebound. In December 2019 we closed the year with more than 3 million jobs and in May 2020 we had 2.9 million jobs. In June we still had some staff cuts. These cuts are expected to be temporary until the processes stabilize.

The employment reductions were mixed. Puebla, Chihuahua, Guanajuato, and Aguascalientes have a strong automotive and auto parts industries and that is why they had a strong contraction in employment because they are working in many cases at 50%. However, other sectors such as electronics, high tech, medical, aerospace have been rebounding, and they have increased their purchase orders.

The companies have made strong investments and ensured the safety of their collaborators, which is why they have been allowed to make contracts in those sectors that had a rebound in their purchase orders.

What changed inside the companies?

It was an internal revolution. We are fighting a virus that is transported through the air, and this industry concentrates a lot of talent and human capital.

Most of the export manufacturing companies in Mexico have sister plants in Asia, so since the beginning of the pandemic we began to take preventive actions.

Having access to information on the good practices they adopted allowed us to implement preventive actions, modifications in layouts or production plans, in cafeterias, in private transport for personnel, in sanitation measures for common areas, in taking samples, diagnostics, implementation of digital systems for facial recognition, measuring temperature and data collection for each of our collaborators to be able to carry out a daily monitoring of their health behavior at least with the most common symptoms. This transformed the operational life for our employees and operations, but also for our society and communities.

It is difficult to maintain social distancing, since we are talking about large populations of people. Fortunately, this industry has a very important collaborative culture such as respect, honesty and teamwork. This work culture that the Mexican export industry has allows us to have collaborators with high social conscience. Implementing new personal protection codes of conduct has been relatively easy. The most difficult challenge has been to overcome the medium.

How did Mexico react to this pandemic?

Mexico showed great response capacity in the manufacture of medical and telecommunications equipment that were vital for responding to the global pandemic. In these sectors we have had a significant increase in purchase orders. We have a golden opportunity to take advantage of it and migrate projects that are being carried out in other regions of the world to our country, and we are experiencing it.

Is Mexico still attractive for Foreign Direct Investment?

Of course. Mexico is a very attractive region not only for international investments but for our own USMCA trading partners. In that sense, we have been asking the government of Mexico to send positive signals so that they generate investment certainty, signals to invite construction and investment in our country in order to continue showing that Mexico is a country and a reliable commercial partner.

The most important thing is to end the signals that show incoordination in some areas of the federal government such as the cancellation of Constellation Brands in Mexicali, the message sent by the Secretariat of Energy and the Electricity Commission regarding contracts and projects for the production of sustainable energy or renewables. These kinds of signals do not favor international investment confidence. On the other hand, the Secretariat of Economy, the Ministry of Foreign Relations and the Ministry of Labor have sent positive signals of collaboration.

How can the federal government help manufacturers to be more competitive?

First, the rules of the game should not be changed without prior notice. Certainty is important and we have our communication channels always open to dialogue and socialize measures that they want to carry out.

Are companies worried about the uncertainty caused by the new federal government?

Yes, since last year some investors have decided to wait for greater clarity in certain decisions that the government is taking. We have made this known to the Mexican authorities, the Mexican Chancellery, so that they have a pulse on the issues of the uncertainties that we are receiving from the companies.

What are the challenges manufacturers are facing now?

The biggest challenge we have is being able to increase the pace of productive activities. We understand sanitary restrictions in some states, and we have significant challenges in modernizing various points of our regulatory framework in order to capture greater business opportunities. We need deregulation; we have not been able to advance this year because we have been busy addressing the urgent matters of the pandemic and reactivating productive opportunities. We need the automation of procedures to avoid discretion. Also, increase certainty in response times. Mexico can be a great recipient of FDI if we agree.

How has the recent fiscal changes impacting manufacturers?

We understand the role of SAT and the economic contraction due to the global pandemic in terms of tax resources that have been reduced, but it is not through VAT that greater confidence and investment attraction in our country will be generated. We must also send messages through the SAT of whether to comply with and adherence to fiscal rules as has always been done in the export industry, but they must also increase facilities and advantages in order to continue taxing and generating wealth.

We are less than 1% of the country’s economic units that generate more than 65% of Mexico’s foreign trade income. We are the first generator of fresh currency for the country. Last year, we generated a trade surplus of US$74 billion. This sector pays the best in salaries and benefits to its workers, almost $17,000 pesos on average, and this sector is the most regulated.