Tesla to Invigorate Texas Auto Industry

By Nancy J. Gonzalez

Tesla has big plans for Texas. The electric vehicle manufacturer is not only building its Gigafactory in the Lone Star State but also is having a multi-million showroom while its CEO, Elon Musk, is calling this state his new home. Musk is also considering moving Tesla’s headquarters from California to Texas if the business climate continues to be the same in the Golden State.

The US$1.1 billion Travis County manufacturing plant is slated for completion before the end of 2021, with some operations potentially coming online as soon as May. The facility is called Giga Texas and will have around 5 million square feet under roof.

Musk has previously confirmed that the Gigafactory will produce the company’s new pickup truck Cybertruck as well as the Tesla Model Y and Tesla Semi, a tractortrailer. Sources said Tesla’s Model 3 might also be built in Texas.

“For Berlin and Austin, we do expect to start delivering cars from those factories next year,” Musk said in October 2020. “Because of the exponential nature of the scaling up of a manufacturing plant, it will start off very slow at first, and the output will eventually become very large.”

Giga Texas is expected to create more than 5,000 jobs over the next four years. Tesla is already hiring a number of manufacturing positions for the factory as well as engineers. According to some job postings, the company is going to have a battery production in Texas, and it is looking for a project manager.

“In Berlin and Austin, we remain on track to start vehicle production this year with structural batteries leveraging in-house battery cells. Our engineering team has made significant progress on Full Self Driving (FSD) software, with a limited release to customers,” said the company in its 4Q-2020 financial report. “Finally, we are excited to ramp the updated Model S and Model X and deliver our first Tesla Semi by the end of the year.”

This investment came with an important tax abatement. Travis County gave Tesla tax breaks worth a minimum of US$14.7 million to build a new car plant—and eventually employ thousands—near the Austin airport. Moreover, the company will also have a property tax incentive by the State of Texas worth approximately US$40 million over a 10-year period.

“Giga Texas is a true gamechanger for our region and is much deserving of this national attention,” said Opportunity Austin Chair Gary Farmer.

During the 4Q-2020 report, Tesla did not disclose the future capacity for the Texas facility, but some auto specialists consider the capacity can be up to 600,000 vehicles per year.

Meanwhile, the construction and equipment of the Gigafactory is going fast. Recently, Tesla received parts for the Giga Press, the company’s giant casting machine at its Texas Gigafactory building site. The exact number of Giga Presses the factory will have is unknown so far.

Also, the company issued a big order of robots for Model Y production at this site early February. Most Tesla production lines require hundreds of robots, and the automaker has been known to use both Kuka and Fanuc robots. This is a positive sign that Tesla is getting ready to start building out its production lines for the Model Y.

Furthermore, Tesla plans to establish battery cell production at the factory and make it an “ecological paradise” open to the public.

Tesla also wants to be closer to its clients and have more physical presence in Texas. Therefore, it has a multi-million showroom project on the way in Austin. Construction is planned to start on mid-June and will be completed by midSeptember. The showroom will be 30,000 square feet.

Under state law, Tesla is prohibited from selling vehicles directly to customers in Texas as well as having test drives. Auto specialist have said Tesla might lobby this year to change this situation. Nowadays, the company can just show the vehicles, but potential clients cannot be informed about prices or test drive the vehicles on site.

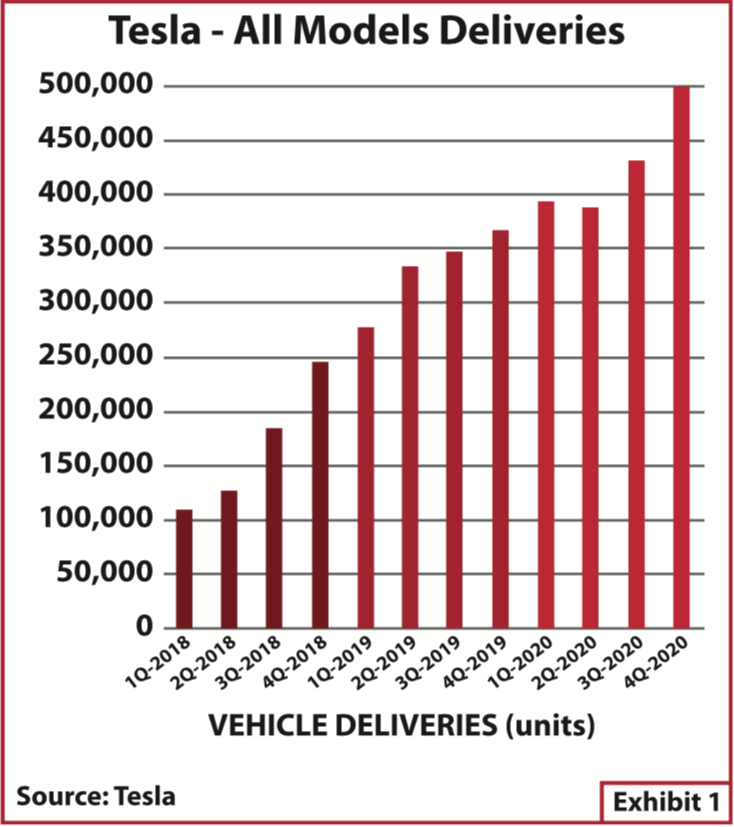

In 2020, Tesla produced and delivered half a million vehicles worldwide and it is “planning to grow its manufacturing capacity as quickly as possible.” The company claims the 2021 production will be higher once the new Gigafactories start operations or increase their capacities.

During the quarterly report, Tesla said it expects to achieve 50% average annual growth in vehicle deliveries. Also, it said the rate of growth will depend on its equipment capacity, operational efficiency and capacity and stability of the supply chain.

“Despite unforeseen global challenges, we outpaced many trends seen elsewhere in the industry as we significantly increased volumes, profitability and cash generation,” said Tesla during the 4Q-2020 financial report. “While 2020 was a critical year for Tesla, we believe that 2021 will be even more important.”

The report also says total revenue grew 46% year to year in the last quarter of the year. This was primarily achieved through substantial growth in vehicle deliveries as well as growth in other parts of the business. Moreover, quarter-end cash and cash equivalents increased to US$19.4 billion in Q4-2020, driven mainly by Tesla’s recent capital raise of US$5 billion and free cash flow of US$1.9 billion, partially offset by early debt repayments.

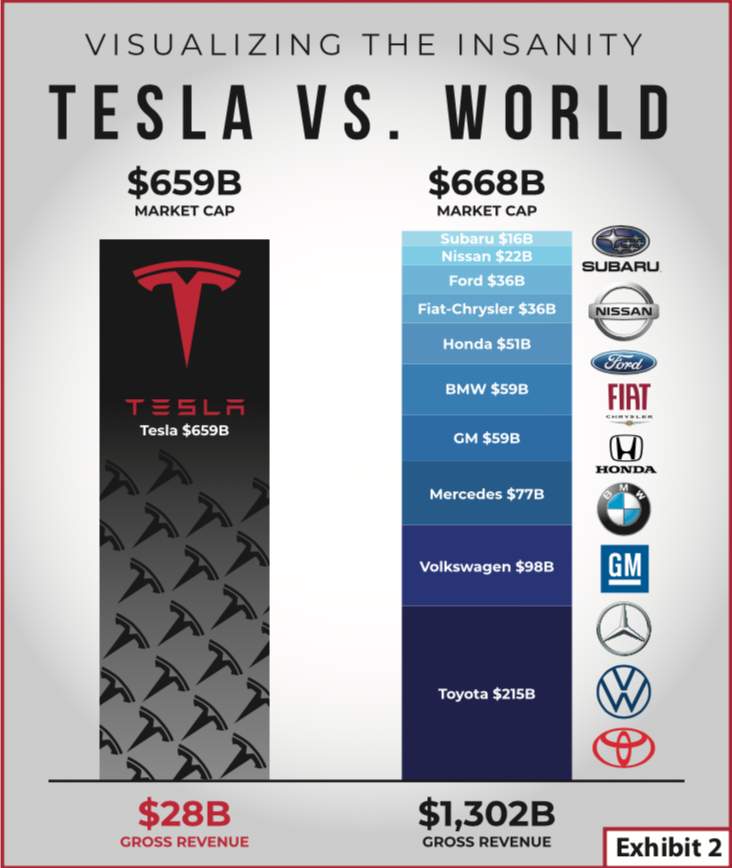

Tesla’s equity market cap is greater than Warren Buffett’s Berkshire Hathaway, a holding company for a multitude of businesses. Tesla’s market cap is compared to 10 other brands altogether. Its gross revenue might be up to US$28 billion.

At the current stock price, the market value of Tesla’s equity is US$825 billion, making Tesla the sixth-largest company by equity market capitalization in the Morningstar U.S. Market Index. At its current market cap, Tesla’s equity is 8 times more valuable than the world’s largest auto manufacturer, Volkswagen, and approximately 7 times the combined equity valuation of both General Motors and Ford, a Morningstar’s recent analysis show.

“We think that Tesla’s stock is significantly overvalued, and at a price/fair value of 2.7 times, it is one of the most overvalued stocks that we cover, ” t h e Morningstar reports. “Embedded within the assumptions of our US$306 fair value estimate for Tesla, we forecast that the firm’s auto sales will grow from just under a half-million in 2020 to an annual selling rate of 3.6 million light vehicles in 2029. That sales rate would represent approximately 19% of global market share for battery electric vehicles (BEVs).”

Meanwhile, Tesla believes 2021 will be a positive year for the company and has high expectations for Giga Texas.